travel nurse taxes in california

What is a deduction and what can you use for a deduction as a Travel Nurse. As an example a travel nurse salary in California on average is 177040 per year.

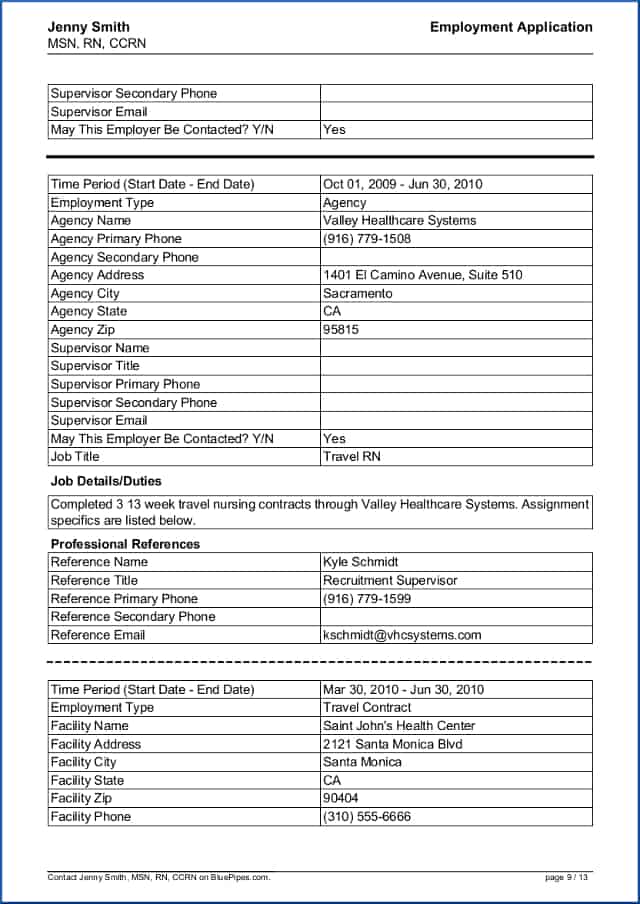

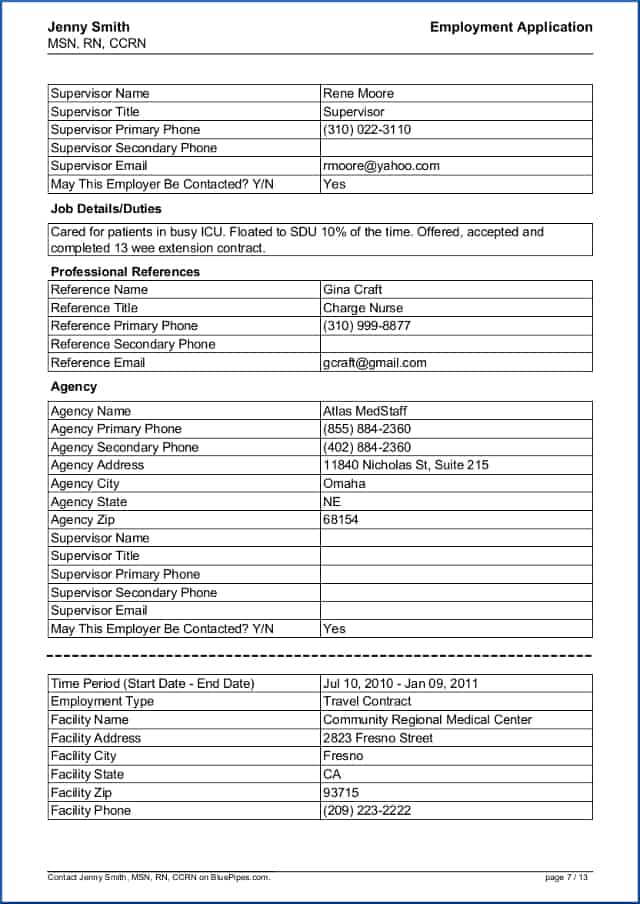

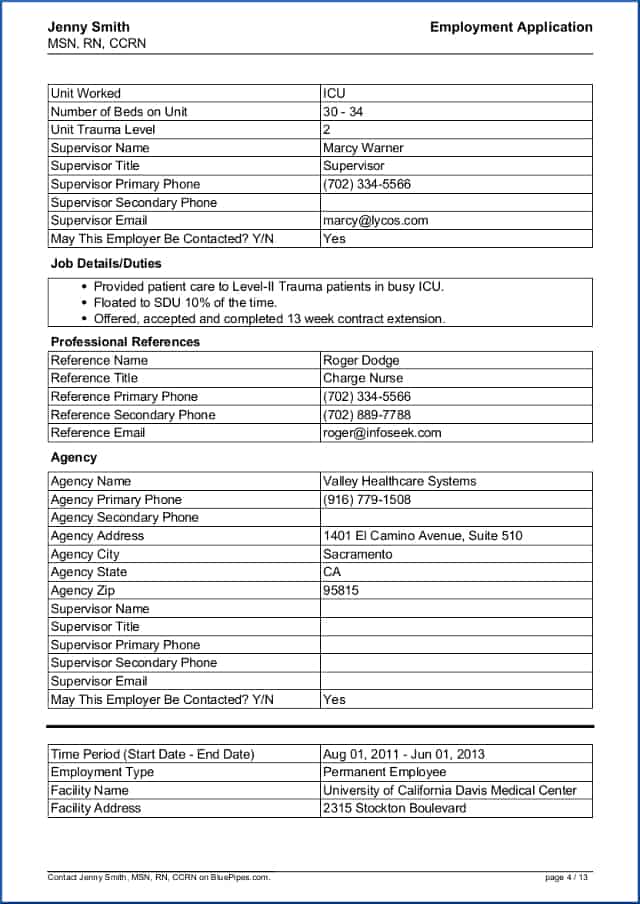

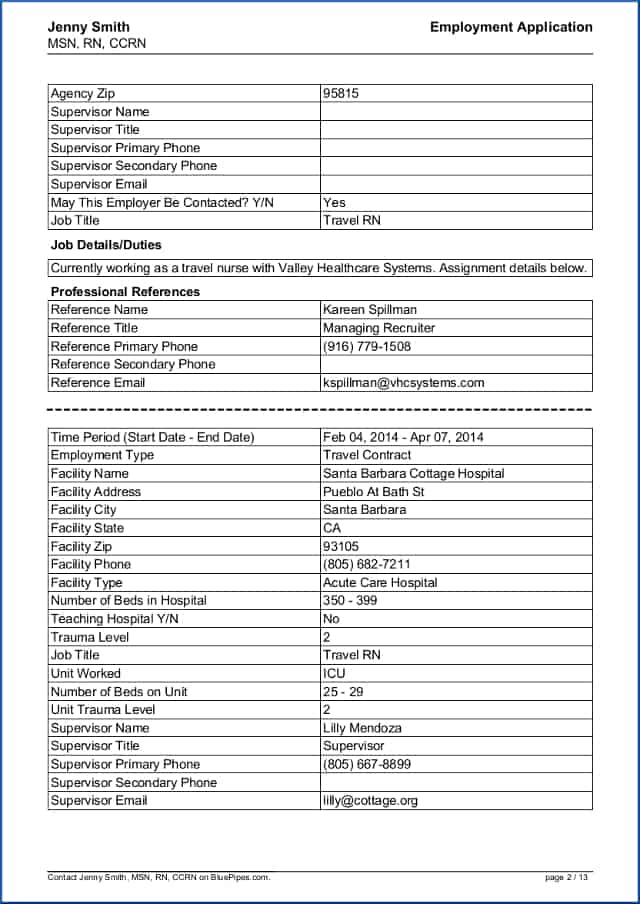

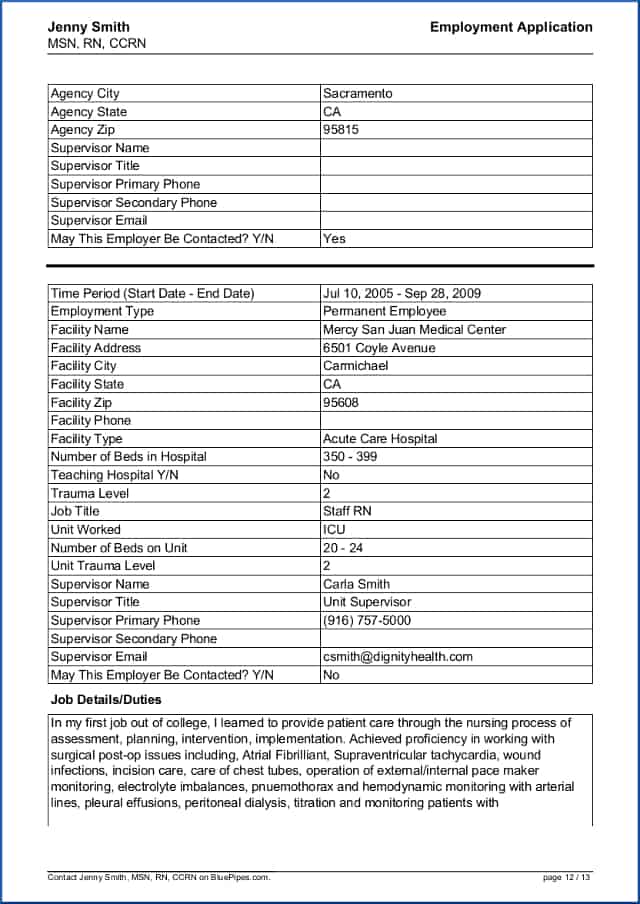

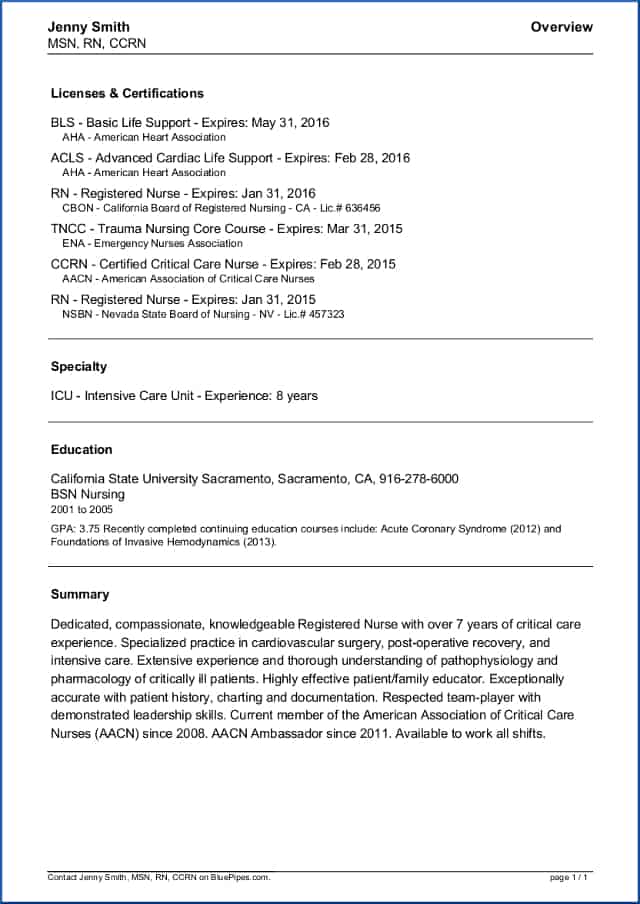

Sample Travel Nursing Job Application Bluepipes Blog

I was a travel nurse for 5 months in CA but was a resident of IN drivers license registration and owned a home and pay property tax.

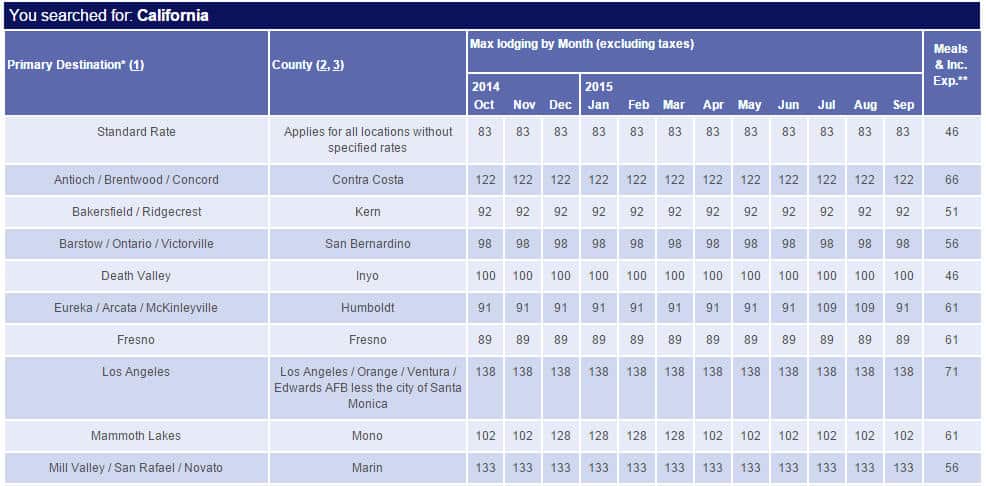

. 24 for taxable income between 85526 and 163300. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Meals and incidental.

Because travel nurses are expected to travel to different parts of the state. That hourly rate includes the tax-free stipends that Travel Nurses can receive. 250 per week for meals and incidentals non-taxable.

Hi travel nurse tax question JA. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Two basic principles are at work here.

If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. Travel nurse tax question.

This is the most common Tax Questions of Travel Nurses we receive all year. But it is pretty close. We represent clients before the IRS Canadian Revenue Agency and state tax agencies in audits and resolutions.

43k salaries reported updated at August 9 2022. Basically only income earned in California is taxed there. CA collected all my income tax for the entire year.

A travel nurse may stay in one state for as long as they like. Use a higher income to qualify for major purchases. Get in the habit of logging expenses daily.

22 for taxable income between 40126 and 85525. Just a few quick questions to understand your situation. The fact that the income was not earned in the home state is irrelevant.

Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. First your home state will tax all income earned everywhere regardless of source. Travel nursing stipends boost your income.

1 A tax home is your main area not state of work. What can cause your tax return to be audited. The costs of your uniforms including dry cleaning and laundry costs.

At the same time the work state will tax the income earned there. Thats the tax rate on one more dollar of income he says. Youll notice that many times the pay for a travel nursing assignment is listed as a blended rate.

Travel nurse earnings can have a tax advantage. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. No matter what your personal situation is it pays to review your financial strategy to limit your risk and tax liability going forward.

Which state should I file my income tax return for first. Any phone Internet and computer-related expensesincluding warranties as well as apps and other. I could spend a long time on this but here is the 3-sentence definition.

Tax break 3 Professional expenses. Tax deductions for travel nurses also include all expenses that are required for your job. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses.

RNs can earn up to 2300 per week as a travel nurse. Next talk to an American Traveler recruiter about our Tax Advantage Plan which keeps more money in your paycheck every week - adding up to 10000 a year for some travelers. Here is an example of a typical pay package.

Not just at tax time. Episode 2 Audit Triggers. Just that I need someone who consult on travel nursing tax questions.

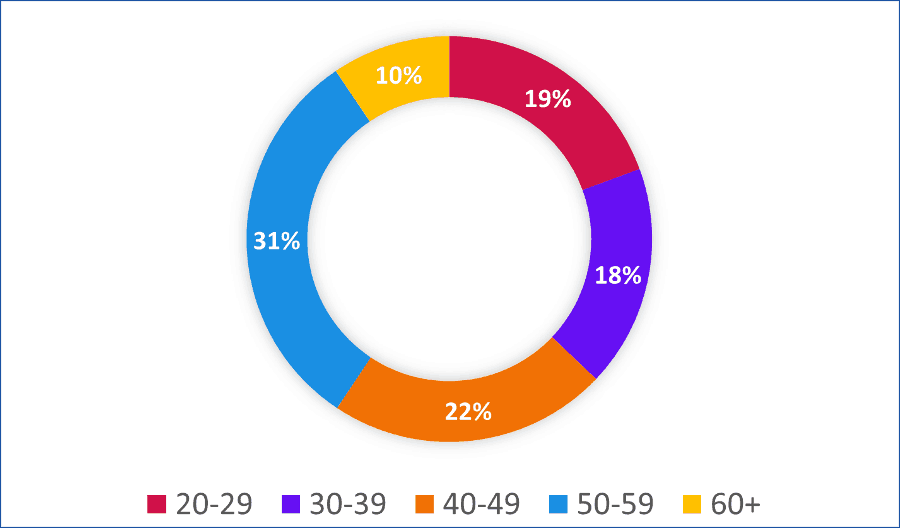

When doing proactive planning Willmann says its important to pay attention to your marginal tax rate. But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence. 401 k View more benefits.

12 for taxable income between 9876 and 40125. Travel Nurse Tax Questions Videos. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes.

Keep all receipts related to your expenses as a travel nurse. The average salary for a travel nurse is 2669 per week in California and 15000 overtime per year. At first glance this sounds like double taxation but this is not the case.

Travel to and from the assignment. This means travel nurses can no longer deduct travel-related expenses such as food. You can reach us at 800-884-8788.

500 for travel reimbursement non-taxable. However for tax purposes they will want to move to different locations in order to avoid spending more than 12 months in the same location in any consecutive 24-month period. Tax-write offs are a unique ability of Travel Nurses and other Allied Pros but this benefit depends on your ability to prove that you have a tax home.

Here are four travel nurse tax strategies that can help. The Accountant can help. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income.

Episode 1 Tax Deductions. Travel Nurse non-taxable income. Housing at your assignment location.

20 per hour taxable base rate that is reported to the IRS. 2000 a month for lodging non-taxable. Ask Your Own Tax Question.

Then was hired at the hospital I was working at sold my house and became an official resident of CA. TravelTax specializes in tax preparation for travel nurses and other travel professionals in healthcare IT engineering nuclear Canadian international foreign missionaries and everybody else. You may even have taken a travel nursing job for the first time.

Other states offer mediocre salaries such as Vermont 105930 and some offer relatively low salaries like Alabama 88440.

Travel Nursing At California Kaiser Hospitals Bluepipes Blog

Sample Travel Nursing Job Application Bluepipes Blog

How Often Do Travel Nurses Get Audited Tns

Sample Travel Nursing Job Application Bluepipes Blog

The Pros And Cons Of Travel Nursing Bluepipes Blog

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Nursing As An Independent Contractor Nurseregistry

Sample Travel Nursing Job Application Bluepipes Blog

How Often Do Travel Nurses Get Audited Tns

6 Things Travel Nurses Should Know About Gsa Rates

6 Things Travel Nurses Should Know About Gsa Rates

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Sample Travel Nursing Job Application Bluepipes Blog

6 Things Travel Nurses Should Know About Gsa Rates

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

6 Things Travel Nurses Should Know About Gsa Rates

Sample Travel Nursing Job Application Bluepipes Blog